Choosing between the CFA and CFI certifications is an important step for anyone building a career in finance.

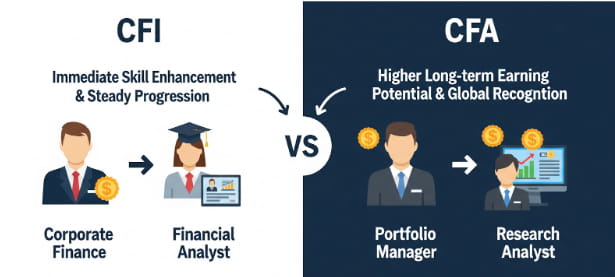

The CFA is known worldwide for its strong focus on investment management, while the CFI teaches practical corporate finance and financial modeling skills in less time. Both can help you grow in your career, but they have different costs, study times, and job opportunities.

In this guide, we explain CFA vs CFI in simple terms, covering course content, exams, fees, salaries, and career paths, so you can pick the one that fits your goals best.

CFI Overview: What Is CFI Certification?

The Corporate Finance Institute (CFI) certification focuses on practical financial modeling skills and Excel mastery for corporate finance applications.

CFI’s core curriculum focuses on economic modeling, company valuation techniques, and advanced Excel functions that professionals utilize daily. The program targets corporate finance analysts, investment bankers, and professionals seeking hands-on skills development.

CFI certification requires approximately 40-60 hours of study time with flexible online learning schedules, making it accessible for working professionals who need immediate skill enhancement.

CFA Overview: What Is CFA Certification?

The Chartered Financial Analyst (CFA) designation is one of the highest distinctions in the investment management profession, focusing on investment analysis, portfolio management, and adherence to ethical standards.

CFA’s comprehensive curriculum covers economics, financial reporting, equity investments, fixed income, derivatives, and alternative investments.

In 2026, the CFA curriculum also includes new “Practical Skills Modules” and specialized Level III pathways in Private Markets and Private Wealth, making it even more relevant to real-world applications. It is designed for professionals such as investment managers, research analysts, and portfolio managers seeking global recognition and credibility.

The CFA program consists of three levels, each culminating in a six-hour exam, requiring over 300 hours of study per level, with strict examination schedules and global standardization.

CFI Vs CFA: Key Differences Explained

The fundamental distinction between CFI certification and CFA certification lies in their respective approaches to finance education, with CFI emphasizing practical applications and CFA focusing on theoretical foundations.

While CFI emphasizes immediate application through hands-on modeling exercises, CFA focuses on comprehensive theoretical knowledge with rigorous examination standards.

| Factor | CFI | CFA |

|---|---|---|

| Duration | 3-6 months | 2.5-4 years |

| Cost | $497-$2,497 | $3,520-$4,600 |

| Difficulty | Moderate | High |

| Focus | Financial modeling & Excel | Investment analysis & portfolio management |

| Prerequisites | None | Bachelor’s degree or equivalent |

CFI programs offer flexible, self-paced learning with immediate practical application, making them ideal for professionals who need to quickly upgrade their skills.

CFI also runs limited-time promotions, especially during events like Thanksgiving, Black Friday, and Cyber Monday, which can make the certification more affordable.

CFA demands structured study schedules that provide comprehensive theoretical mastery, offering globally recognized credentials for careers in investment management.

The study requirements differ significantly: CFI allows retakes and flexible scheduling, while CFA maintains strict examination windows and limited retake opportunities.

Industry recognition patterns reveal distinct career paths: CFI certification enhances corporate finance roles with practical modeling skills, while CFA opens doors to investment management positions with prestigious global recognition.

CFI Vs CFA Cost And Platform Breakdown

Understanding the financial investment required for each certification helps professionals make budget-conscious decisions while considering long-term career returns and skill development outcomes.

CFI Platform & Fees

- Platform: Online learning through the Corporate Finance Institute’s proprietary system.

- FMVA Program: $497 individual course, $997 complete certification bundle.

- CBCA Program: $997 for commercial banking analyst certification.

- Individual courses: $97-$297 per specialized financial modeling course.

Although some find CFI pricing higher initially, discounts and promotions often make it more accessible for learners looking to enhance their corporate finance skills.

CFA Platform & Fees

- Platform: CFA Institute’s official examination system with global testing centers.

- Registration Fee: The CFA Institute removed the one-time $350 enrollment fee effective April 29, 2025.

- Level I, II, III exams: $940-$1,450 per level, depending on registration timing.

- Total CFA cost: $3,520-$4,600 to complete all three levels and become a Charterholder.

The cost differential reflects different value propositions: CFI provides immediate practical skills at a lower investment, while CFA requires a substantial financial commitment for a globally recognized professional designation.

CFI Vs CFA Salary And Career Opportunities

Career impact analysis reveals distinct earning potential and professional advancement opportunities based on the chosen certification path and targeted industry sectors.

| Aspect | CFI | CFA |

|---|---|---|

| Entry-level salary | $55,000-$75,000 | $70,000-$95,000 |

| Target roles | Financial Analyst, Corporate Finance | Portfolio Manager, Research Analyst |

| Industry focus | Corporate Finance, Banking | Investment Management, Asset Management |

CFA charterholders with bachelor’s degrees earn a median total income of $190,000, while those with MBAs earn up to $257,000.

CFI certification, meanwhile, delivers quick skill upgrades that translate into faster job readiness and smoother career growth in corporate finance.

Students often face financial constraints when starting out, but both programs occasionally offer student discounts to make professional learning more affordable.

A return on investment (ROI) analysis reveals that CFA offers a higher long-term earning potential, despite incurring greater upfront costs.

Geographic considerations are significant: CFA enjoys universal recognition across global financial centers, whereas CFI recognition varies by regional corporate finance markets and industry acceptance.

Both certifications offer distinct value propositions depending on career stage, geographic location, and specific industry targeting within the broader finance sector.

Which Certification Should You Choose: CFI Or CFA?

Your career goals, current experience level, and available time commitment should guide this decision framework.

Choose CFI if you need immediate practical skills for corporate finance roles, have limited study time, or want cost-effective skill enhancement. The timing of your enrollment can impact costs, as seasonal promotions during Black Friday and Cyber Monday offer substantial savings.

Select CFA if you’re targeting investment management careers, can commit to 2-4 years of intensive study, and value globally recognized credentials for long-term advancement.

Related Reads:

Conclusion: CFA is a Long-Term Investment, CFI is a Short-Term Skill Boost

For most finance professionals seeking long-term career advancement, CFA certification offers superior global recognition and earning potential, albeit at a higher cost and with a greater time commitment.

This comparison shows CFA provides a broader academic and professional foundation, while CFI delivers faster, job-ready results.

Personal career alignment remains crucial when choosing between these investment certifications. Make your decision based on a realistic assessment of time availability, financial resources, and specific career objectives.

FAQs

You can pursue both certifications simultaneously, as CFI offers flexible online learning, while CFA follows structured examination schedules, allowing for complementary skill development.

CFI certification has growing international recognition, but CFA enjoys broader global acceptance and prestigious status across worldwide financial institutions and regulatory bodies.

CFI certificates don’t require formal renewal but offer continuing education updates. CFA charterholders are required to complete 20 hours of continuing education annually and pay membership fees.

CFI certification suits career switchers who need immediate practical skills and a faster completion time, while the CFA provides a comprehensive foundation in knowledge for those seeking a serious finance career transition.

Alternatives include FRM (Financial Risk Manager), CPA (Certified Public Accountant), and CAIA (Chartered Alternative Investment Analyst), depending on specialized career interests.