If you want to take a Corporate Finance Institute (CFI) free course, have a look at the courses from my list. CFI offers quality courses on its learning platform. However, the paid courses start at $297, which can be expensive for some.

Free courses on Corporate Finance Institute (CFI) can provide a cost-free learning solution for business studies students and finance or banking enthusiasts.

I have taken many free courses offered by CFI and benefited from them personally and professionally. Don’t believe me? Start with these free courses and discover how insightful they can be.

Does The Corporate Finance Institute (CFI) Offer Free Courses?

CFI offers learners 28 free courses currently, andaims to provide everyone with financial knowledge through its online learning platform.

The good news is that CFI offers free certificates and CPE credits to its free course takers in addition to courses. This is quite a generous offering that I have yet to see on any other platform.

Below are the top 10 CFI free courses in tabular format with all their details for your quick reference. Their detailed reviews are later in the article.

| Course Name | CPE Credits | Level | Best For | Course Link |

|---|---|---|---|---|

| Accounting Fundamentals | 2 | 2 | Fundamental concepts related to accounting | Link |

| Excel Fundamentals | 3.5 | 2 | Excel 365 for finance | Link |

| Reading Financial Statements | 1 | 2 | Making sense of companies’ financial statements | Link |

| Corporate Finance Fundamentals | 2.5 | 2 | Learn about capital raising, valuation, mergers, acquisitions | Link |

| Capital IQ Fundamentals | 1.5 | 1 | Learn to use the CapIQ platform and its plug-in | Link |

| Introduction to BI | 1.5 | 1 | Learn the difference between business intelligence & data science | Link |

| Introduction ESG | 1.5 | 1 | Environmental, Social, and Governance Framework | Link |

| Fundamentals of Credit | 2 | 1 | Learn basic terminology related to credit | Link |

| Introduction to Banking | 2 | 1 | Basics about financial institutions and their workings | Link |

| Data Science & Machine Learning Fundamentals | 3.5 | 2 | Improving business using insights based on data | Link |

Note: CPE stands for Continuing Professional Education credits, which are required by accountants and IT specialists to maintain their licenses or certifications. Find More details on CPE here.

Step-by-Step Guide To Start A Corporate Finance Institute (CFI) Free Course

It is very easy to start your learning journey on CFI. Simply follow the steps given below.

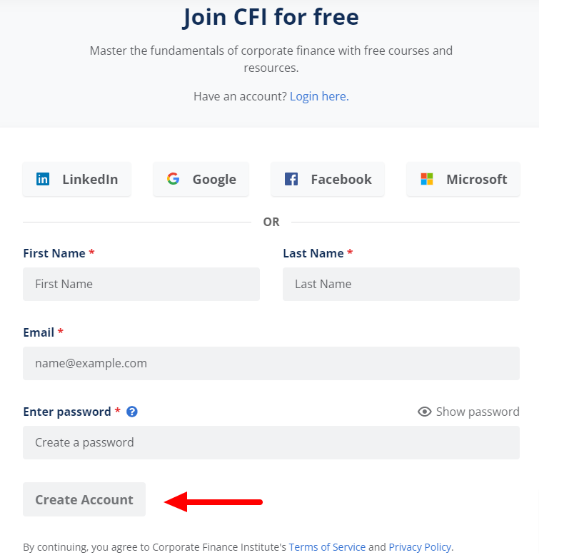

Step 1- Sign In Or Create An Account

You can create a free account on CFI using your email ID. Just fill in the basic information like your name, email address, and new password. Hit “Create Account” and your account will be ready.

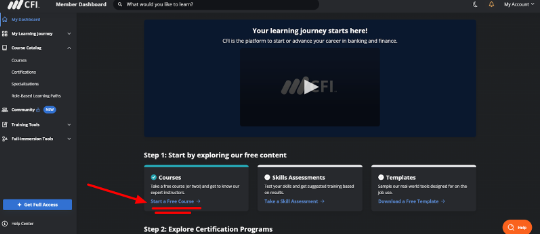

Step 2 – Choose The Free Course Option

On your dashboard, choose the “Start a free course” option, as shown in the image below.

Image Source- Corporate Finance Institute

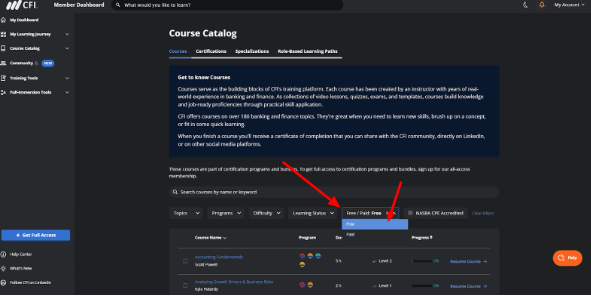

Step 3- Use The Filter To Find The List Of Free Courses

In the courses catalog, you will find a few filters, click on the “Free/Paid” Filter, and in the drop-down choose the option “Free.”

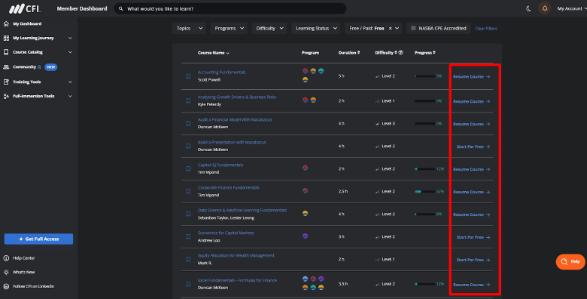

Step 4 – Pick A Free CFI Course

You can now start a course of your choice for free by clicking the “Start For Free” course option appearing on your screen’s right side highlighted in the image below.

Note- CFI offers more free courses on YouTube. Visit Corporate Finance Institute’s YouTube channel to learn more.

Corporate Finance Institute (CFI) Free Courses- 10 Free Certificate Courses

I have taken a few free CFI courses to make suggestions for you. Here are the top 10 CFI free courses described in detail. If you don’t find a course you want to pursue, check the whole list on the platform here.

Disclaimer: Even though all the courses are beginner-level, they have levels that give course takers an estimate of how difficult the course might be from a beginner’s perspective. 1 being easy, 2 a little more difficult, and so on.

1. Accounting Fundamentals

| Course Name | Accounting Fundamentals |

| Time Taken | 5 Hours |

| Level | 2 |

| What will you learn? | Financial statements, income statement, balance sheet, and cash flow statement |

This Course is Part of the FMVA® Certification. Accounting Fundamentals is excellent for new financial analysts to learn the basics that are the backbone of accounting. Experts can also use this Level 1 course to refresh their knowledge.

The Course perfectly balances video, reading, and interactive exercises. My takeaway from this course was that I learned how to balance a sheet. I also got an insight into reading income statements which will help me plan my budget better.

Who is this course for?

- Financial Planner

- Investment Advisor,

- Portfolio Manager

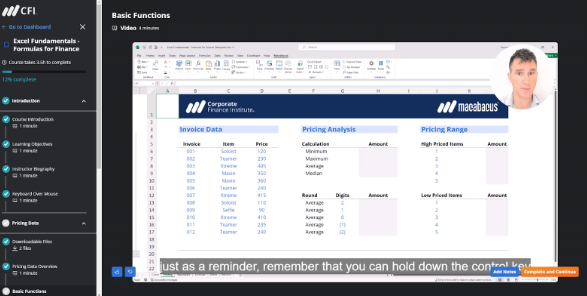

2. Excel Fundamentals- Formulas For Finance

| Course Name | Excel Fundamentals- Formulas for Finance |

| Time Taken | 3.5 Hours |

| Level | 2 |

| What will you learn? | Excel 365, tools, and shortcuts |

The Excle Fundamental course will teach you the best formulas and functions for financial analysis. The level 2 course will teach you the fundamental functions of performing statistical analysis on data sets in Excel 365.

A summary sheet was also provided during the course, which I found incredibly helpful. It had all the essential notes taught during the program and keyboard shortcuts you can use while using Excel.

Who is this course for?

- Finance enthusiast

- Accountants

3. Reading Financial Statements

| Course Name | Reading Financial Statements |

| Time Taken | 1.5 Hours |

| Level | 2 |

| What will you learn? | Income statement, Cash flow statement, annual report |

Reading financial statements is extremely important as it enables a financial analyst to understand a company’s finances and make plans for its growth.

It is best to take the Accounting Fundamental course before the Reading Financial Statements course, as it assumes you know the fundamental terms and workings.

Who is this course for?

- Financial Planner

- Investment Advisor

- Portfolio Manager

4. Corporate Finance Fundamentals

| Course Name | Corporate Finance Fundamentals |

| Time Taken | 2.5 Hours |

| Level | 2 |

| What will you learn? | Capital markets, capital raising, valuation techniques, acquisition, debt securities, equity securities |

If you want to build a career in corporate finance, the Corporate Finance Fundamental course will teach you all the critical concepts you need to know.

You will learn about different players in capital markets, funding, Business valuation methods, Mergers and acquisitions (M&A) processes, and more.

Who is this course for?

- Invest Bankers

- Researcher in the finance sector

- Finance enthusiasts

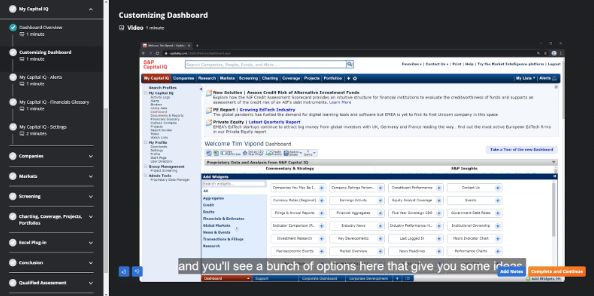

5. Capital IQ Fundamentals

| Course Name | Capital IQ Fundamentals |

| Time Taken | 2 Hours |

| Level | 2 |

| What will you learn? | Capital IQ platform, Companies, Research, Markets, Screening, Charting, Coverage, Projects, and Portfolios |

The Cap IQ course is a step-by-step video instruction guide on using the Capital IQ platform and its built-in templates and formula builder.

Learning the CAP IQ tool will make your career easier in many fields, such as investment banking, equity research, investment management, and private equity.

Who is this course for?

- Finance Enthusiasts

- Invest Banking novices

- Financial planning and analysis (FP&A)

- Corporate Development

6. Introduction To Business Intelligence (BI)

| Course Name | Introduction to BI |

| Time Taken | 1 Hour |

| Level | 1 |

| What will you learn? | Data visualization, data warehousing and transformation, data modeling and analysis |

In this Introduction to BI course, I understood the fundamental difference between business intelligence and data science used in business.

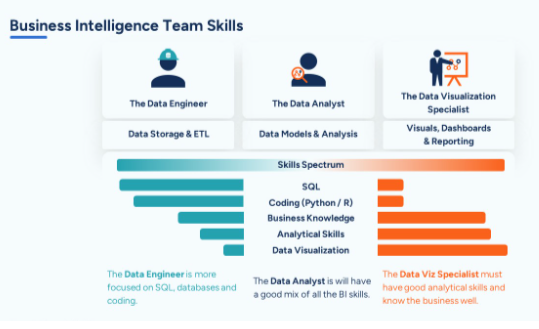

As shown in the image above, the course teaches learners the key roles and duties of each corporate finance employee designation.

Who is the course for?

- Business intelligence analyst

- Data scientist

- Data visualization specialist

7. Introduction To ESG

| Course Name | Introduction ESG |

| Time Taken | 1.5 Hours |

| Level | 1 |

| What will you learn? | ESG, ESG Factors, Corporate Pressures & Stakeholder Expectations, Key Considerations for Companies & Investors |

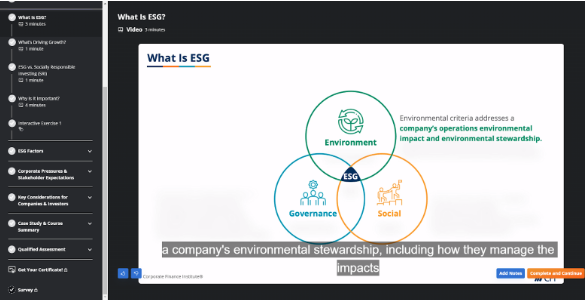

In this course, learners learn about the ESG framework (Environment, Social, Governance) and its issues. They will also learn what drives a corporation’s growth and the difference between ESG and Socially Responsible Investing (SRI).

I have observed that I learn things better when given an example of how a concept is applied, and that is precisely what this course does. A case study is provided that helps learners understand and apply all the knowledge they learn in real life.

Who is this course for?

- Asset Management

- Management Consulting

- Business Analyst

- Credit Analyst

- Corporate Development

- Senior Leadership

8. Fundamentals Of Credit

| Course Name | Fundamentals of Credit |

| Time Taken | 2 Hours |

| Level | 1 |

| What will you learn? | 5 Cs of Credit framework, trade credit, CAPEX, Interest, Loans, Debt, Security |

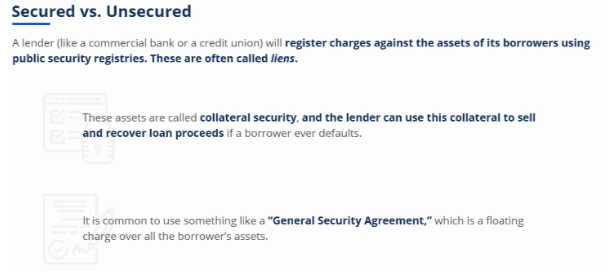

After completing the Fundamentals of Credit course, you can define credit, its types, and how it is created. I found this course interesting as I learned how credit is the lifeline of any business and its growth.

I feared learning so many technical terms could get boring, but kudos to CFI. The course is designed to keep learners engaged with interactive exercises that ensure understanding of the subject.

Who is this course for?

- Business and commercial bankers

- Credit analysts

- Real estate lenders

- Equipment Finance

- Loan & mortgage brokers

- Private (non-bank) lenders

9. Introduction To Banking

| Course Name | Introduction to Banking |

| Time Taken | 2 Hours |

| Level | 1 |

| What will you learn? | Types of financial institutions, products, and services, how a bank generates return |

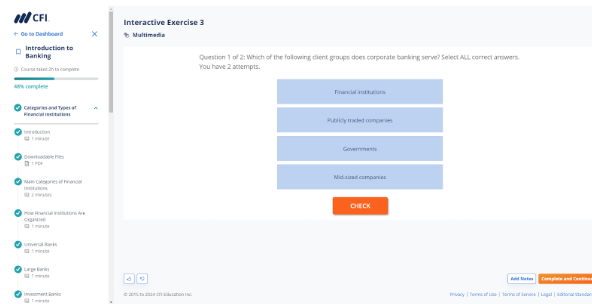

The course is taught and designed by working experts in financial accounting and analysis, risk and controls, capital investment appraisal, budgeting, and financial management.

In this beginner-friendly course, you will learn how banks work, something that we should have been taught in schools long ago. Going to the bank has always been boring, but not anymore since I see all the things I have learned unfold in front of me.

Who is this course for?

- Credit analysts working in insurance

- Credit Analyst

- Account Manager

- Bankers

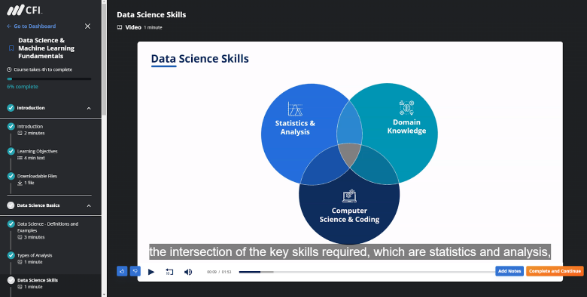

10. Data Science & Machine Learning Fundamentals

| Course Name | Data Science & Machine Learning Fundamentals |

| Time Taken | 4 Hours |

| Level | 2 |

| What will you learn? | Roles behind data science, using statistics to make insights |

This course is the opposite of the earlier-mentioned “Introduction to Business Intelligence,” here, you learn to distinguish what a data science analyst does differently from the former.

Learn to use statistics to help businesses prepare error-free data that provides valuable insights into business plans and eliminates uncertainty in analysis and decision-making.

Who is this course for?

- Aspiring analyst

5 Corporate Finance Institute (CFI) Free Courses Benefits

Here is how you can benefit from taking the CFI free courses –

- Free Certificates- Get course completion certificates on completing your course.

- CPE/CPD Credits- Acquire CPE credits to help you maintain your Certified Public Accountant (CPA) or similar licenses/ certifications.

- Free Downloadable Material- When you take a free course on CFI, you also get extra study material and resources that can be downloaded.

- Good trial- Before you pay for the whole course, use these free courses as a trial to learn whether you like CFI’s teaching style and course structure

- Self-paced & convenient- The courses on CFI can be taken from anywhere as per your convenience as long as you have a laptop or a computer connected to the internet.

Corporate Finance Institute (CFI) Free Templates

While browsing, I found a few free templates and resources on CFI’s platform. The list of these resources is given below in brief. I hope they are helpful to you the same way they were to me.

1. Basic Excel Formulas

Learn and practice keyboard shortcuts with this free template from CFI curated specially for finance professionals.

Both beginners and professionals can benefit from knowing additional formulas and functions used in Excel and save precious time.

2. Financial Modeling Guidelines

This guide is designed to help learners practice their financial modeling skills. Submit the form found in the middle of this page to download your guide and make your journey in Financial Modeling easier.

3. Career Map

Check this link to this informative article that gives you a clear road map of your journey in corporate finance. You will also find helpful tips on using the map to accelerate your career growth.

Conclusion- CFI Free Courses Are A Jackpot For Learners!

I have only discussed the top 10 CFI free courses in detail here, but I insist you check the list of all 28 free courses currently offered on the learning platform.

These courses are easy to understand and interactive, and a boring corporate finance subject like accounting or fundamentals of credit seems fun.

Use this article as a guide to create your free account and start your learning journey today with the Corporate Finance Institute.

FAQs

CFI’s FMVA course is not free, and it starts at $497/ year. However, you can try out the free preview and parts of the FMVA course for free by signing up for CFI.

CFI certifications are accredited and widely recognized by private and government institutions in finance and accountancy, making them totally worth it.

Most CFI courses are designed to be comprehensive so that anyone without prior knowledge can benefit from them, making them suitable for beginners.

The Corporate Finance Institute’s fees start at $297 for individual courses, and you can get a membership plan starting at $597.

CFI offers discounts from time to time. To learn about new discounts, visit their website or subscribe to their email.