Getting into finance isn’t easy. Most jobs ask for skills you only really learn once you’re hired, which makes starting out pretty confusing.

The Corporate Finance Institute’s FMVA certification is designed to fix that. It teaches practical financial modeling and valuation skills that you can actually use on the job.

But is it really as useful as it sounds, or just another online course with a certificate at the end?

I reviewed the details of the FMVA program, including its cost and the career boost it offers in 2026, to help you decide if it’s the right choice for you.

CFI FMVA Certification: Quick Overview

The Financial Modeling & Valuation Analyst (FMVA) is still CFI’s flagship certification. It’s built to give you job-ready skills in financial modeling and valuation, which are exactly what finance recruiters look for.

In 2026, CFI updated the FMVA program with new core courses (Auditing & Balancing a 3-Statement Model and Comparable Valuation Fundamentals) and retired some older electives. They also introduced specializations like AI for Finance, Investment Banking & Private Equity Modeling, and Accounting for Financial Analysts.

CFI continues to grow its presence in the online finance education space, with over 2 million learners globally. Employers in corporate finance, FP&A, and investment banking still see it as a valuable credential.

Who is FMVA for?

The FMVA certification works for a bunch of different people in finance:

- Financial analysts who want to level up their modeling skills

- Investment bankers who need to master valuation techniques

- Corporate finance & FP&A professionals looking to build better budgeting and forecasting abilities

- Accountants, consultants, aspiring finance professionals, and career changers who want to break into finance

FMVA At A Glance

Here is a quick overview of CFI’s Financial Modeling & Valuation Analyst (FMVA) Certification:

| Feature | Description |

|---|---|

| Provider | Corporate Finance Institute (CFI) |

| Focus | Financial Modeling & Valuation Analysis |

| Format | 100% Online, Self-Paced |

| Time Commitment | Approx. 120–200 hours (flexible) |

| Prerequisites | Basic Excel & Accounting recommended (prep courses available) |

| Cost | From $347.90 (offer price) |

| Student Discount | 50% off |

| Recognition | Highly valued by employers in corporate finance, investment banking, and PE |

| Best For | Aspiring/junior finance pros, career changers, and upskillers |

| Key Skills Gained | Building 3-statement models, DCF/Comps valuation, and financial analysis |

Now, let’s get into the details and see if it works for you or not.

CFI FMVA Course Structure

The FMVA follows a logical path from basics to advanced stuff. Get a 30% discount on regular prices with the CFI FMVA Coupon Code 2026.

| Phase | Component | Description |

|---|---|---|

| Prep Courses | Excel for Finance and Accounting | Choose from 9 optional courses to learn or review the fundamentals. |

| Core Courses | Financial Modeling, Valuation | Complete 14 required core courses to build your skill set in financial modeling & valuation analysis. |

| Electives | Several topics | Choose a minimum of 3 electives (out of 9 available) to master more advanced topics and specialized areas. |

| Case Studies | Case Study Challenges | These case study challenges allow you to apply your knowledge and skills by solving real-world problems. |

| Final Exam | Assessment | Final exam (with a minimum passing grade of 70%) to earn your program certification. |

The curriculum has prep courses, core modules, specialized electives, and a final assessment for individual learners.

For customized learning solutions for your team, please visit the CFI for Business page and click on the “contact us” page.

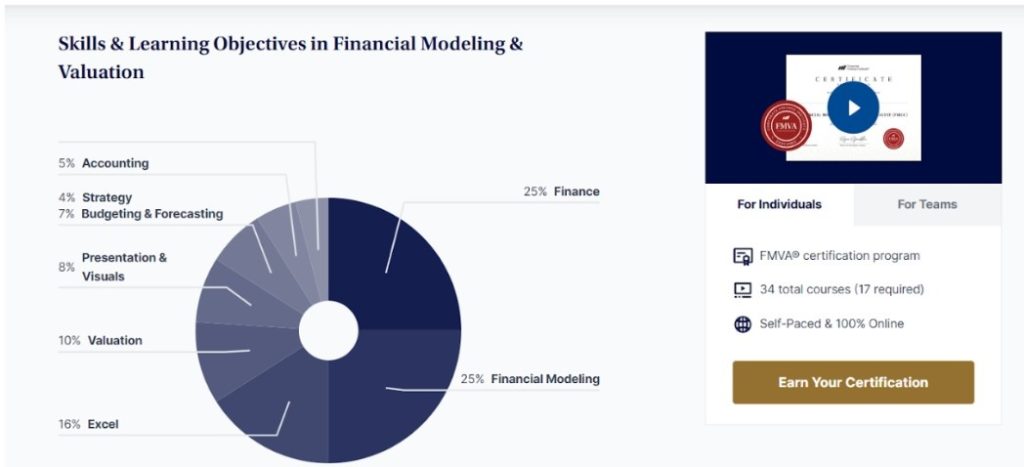

CFI FMVA Curriculum: What You’ll Learn

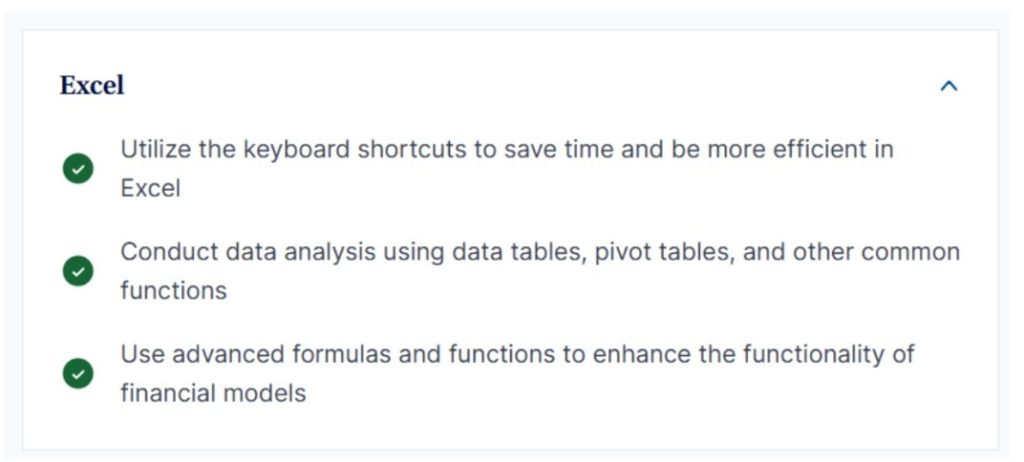

If you’re starting from scratch, you’ll begin with Excel and accounting basics, but if you already have experience, you can jump straight to the advanced modeling stuff.

1. Excel Fundamentals: You’ll get really good at advanced data analysis, dynamic formulas, and creating professional dashboards that actually look impressive.

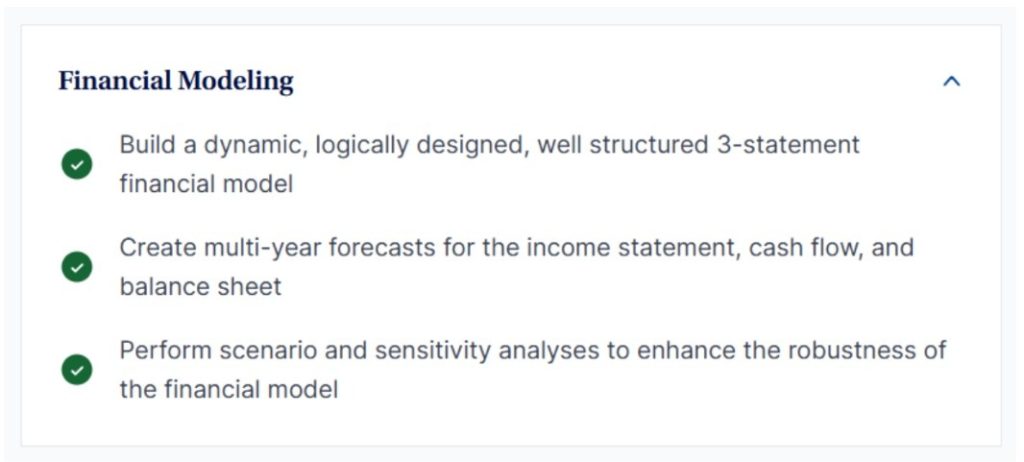

2. Financial Modeling: You’ll learn to build those three-statement models with scenario planning and sensitivity analysis that finance pros use daily.

3. Valuation Techniques: You’ll master industry-standard DCF modeling, comparable company analysis, and precedent transaction methods that investment professionals rely on.

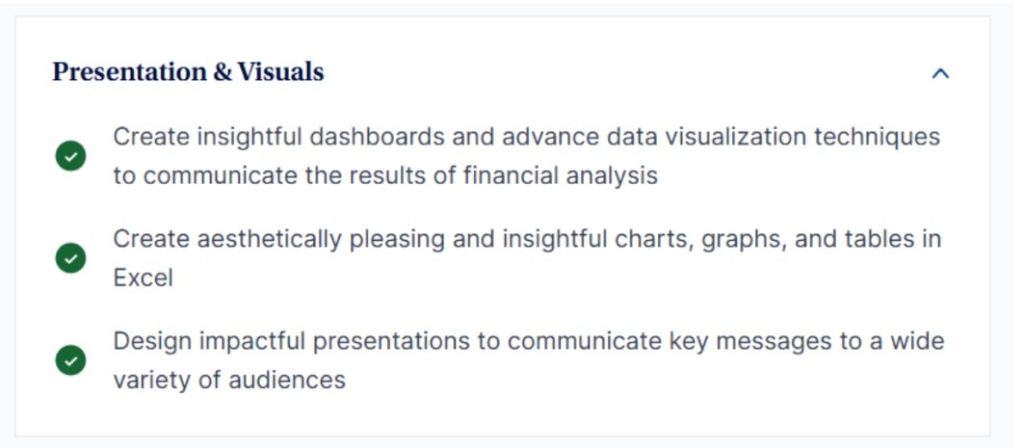

4. Presentation and Visuals: You’ll work through real case studies, complete hands-on assignments, and prove your skills through project-based evaluations.

5. Corporate Strategy & Budgeting: You’ll understand how business performance reviews work, strategic planning frameworks, and advanced forecasting techniques.

The curriculum goes deeper than you’d expect with electives and real industry relevance.

Benefits Of CFI FMVA

The FMVA platform focuses on actually doing stuff rather than just theory:

- Interactive Modules: Video lessons come with downloadable Excel templates and quizzes.

- Simulation Case Studies: Realistic business scenarios from startup financial modeling to complex M&A analysis using real company data.

- Support System: There’s a responsive student forum, direct access to instructors for Q&A, and lifetime updates to materials for ongoing support.

- Mobile & Desktop Access: Works on any device with seamless syncing, so you can learn wherever you are.

- Assessment Methods: You’ll do quizzes, hands-on assignments, and a comprehensive capstone project .

- Self-Paced Flexibility: You can knock this out in 3-6 months if you put in 4-6 hours per week.

- Lifetime Access: All materials get updated regularly, and you keep access to everything forever.

The platform is way more user-friendly than competitors like Coursera or edX, with intuitive navigation and a clean interface.

Students really appreciate getting templates and models they can actually use right away, though some mention occasional video loading hiccups during busy times.

CFI FMVA Prerequisites & Difficulty Level

Let’s talk about what you need to know going in:

- Better if you have knowledge of Excel functions and basic accounting, but CFI has prep courses if you’re starting from zero.

- Challenge Level enough for beginners who put in effort, but engaging enough for professionals who want to refresh or advance their skills.

- Preparation Path if you’re switching careers, take all the prep courses. If you’re a recent finance grad, focus on the advanced modeling stuff.

CFI FMVA Pricing Plans

The FMVA pricing has several options depending on your budget and learning style:

| Plan Name | Regular Price (Annual) | Discounted Price | Who Qualifies / How to Access |

|---|---|---|---|

| Self-Study | $497 | $347.90 (30% off) | Everyone (currently active web promo) |

| Full-Immersion | $847 | $592.90 (30% off) | Everyone (currently active web promo) |

| Student Discount | $497 | $248.50 (50% off) | Full-time students |

| Team/Business | $399+ per user | Varies by team size | Corporate/organizational purchase |

No surprise costs for content, though you might pay extra for exam retakes or personalized coaching.

Everything’s included—course materials, lifetime updates, and post-completion resources, so your investment is transparent and comprehensive. Check out our CFI pricing guide for a detailed pricing breakdown.

CFI FMVA Student Discount

Students get a pretty great deal with the discount program. Full-time students with verifiable higher education email addresses get 50% off all FMVA programs.

You can’t stack student discounts with other offers, but this is already the biggest savings available. For complete details on eligibility and the application process, visit our student discount page.

Career Impact & Outcomes of CFI FMVA

The FMVA certification shows real career benefits across multiple areas. You’ll be qualified for roles like financial analyst, associate positions, finance manager, FP&A specialist, and consulting roles.

Those who have certificates earn 15–20% more than non-certified peers, with US investment analysts averaging $84,000, and annually, financial managers make over $100,000.

More than 85% of hiring managers prefer candidates with solid certifications, and the best job markets for FMVA roles include major US financial centers.

But let’s be real, certification improves your profile but doesn’t guarantee a job. You’ll still need to network, gain experience, and nail your interviews.

CFI FMVA vs. Other Certifications

Here’s how FMVA stacks up against other credentials. For an in-depth comparison with the CFA specifically, read our detailed FMVA vs CFA analysis.

| Certifications | FMVA | CFA | FRM | CPA/CMA |

|---|---|---|---|---|

| Focus Area | Modeling & Valuation (Practical) | Investment Analysis, Portfolio | Risk Management | Accounting/Management Accounting |

| Cost | ~$350 | $2,500+ | $1,200+ | $2,000+ |

| Duration | 3–6 months | 4+ years | 1–2 years | 1–2 years |

| Recognition | High in banking, finance | Highest (investment industry) | High (risk, insurance, banks) | Accounting, corporate |

| Who It Suits | Early-career, switchers | Investment research, fund mgmt | Risk, audit, compliance | Accountants, controllers |

People who’ve done both FMVA and CFA say that FMVA gives you faster practical application and immediate job readiness. At the same time, CFA offers a broader theoretical foundation and higher long-term prestige.

Pros And Cons Of The CFI FMVA

Here are pros and cons of the CFI Financial Modeling & Valuation Analyst certification:

| Pros | Cons |

|---|---|

| Practical, desk-ready skills with real project experience | Not a substitute for a degree or specialist licenses |

| Flexible, self-paced for working professionals | Limited value for those in highly quantitative finance or senior roles |

| Highly affordable vs. competitor credentials | Employer recognition is strong in banking/corporate finance, less so in certain public sectors |

| Industry-recognized templates and models | Requires self-motivation for the online learning format |

| Strong alumni network and job placement support | May not meet regulatory requirements for certain positions |

You can get all the skills and a valid certificate from here, but you will still need a valid license to follow your specialization in private sector or business.

CFI FMVA: Who Is It For?

The FMVA certification works best for specific types of professionals.

Best For: Recent grads who need practical skills, aspiring analysts without finance backgrounds, mid-career professionals switching to finance, business majors who need hands-on credibility.

Less Suited For: Portfolio management specialists, actuarial science professionals, senior executives who need high-level leadership credentials, or anyone seeking regulatory compliance certifications.

Before taking the paid program, explore CFI’s free courses to get an idea of their teaching style and content quality.

Tips For Success if You Enroll in CFI FMVA

Getting the most out of your FMVA investment takes some strategy and consistency:

- Schedule Management: Set up weekly 4–6 hour study blocks at consistent times for better learning retention.

- Community Engagement: Jump into learner forums for peer support, feedback, and networking opportunities.

- Professional Integration: Combine your FMVA completion with LinkedIn updates and strategic networking for maximum career impact.

- Extended Practice: Work through extra case models beyond required assignments to build deeper expertise and confidence.

Conclusion: FMVA Delivers Practical Value For Finance Careers!

The CFI FMVA offers a real bridge between classroom concepts and desk-ready skills, with solid recognition among finance employers and flexibility for learners at all stages.

If you want practical modeling skills and career momentum in finance, it’s a solid choice but it’s not a magic bullet for every position.

The certification works best when you combine it with networking, experience, and a clear career strategy.

FAQs

Most students finish the FMVA in 3-6 months with 4-6 hours of weekly study. The self-paced format works great for working professionals.

Yeah, the FMVA has solid recognition in major financial centers globally, including North America, Europe, and Asia-Pacific markets.

CFI offers a refund policy within the first 30 days of enrollment, so you can try it risk-free.

Nope, no prior finance experience required. The program includes prep courses in Excel and accounting fundamentals for beginners.

FMVA gives you focused, practical skills that complement but don’t replace an MBA. It’s way more cost-effective for specific finance skills but lacks the broader business education and networking opportunities of an MBA program.